- Jim Richards Twitter Trump

- Jim Richards Twitter

- Jim Rickards Twitter Currency Wars

- Jim Rickards Twitter

- James Rickards Scam

- Jim Rickards Website

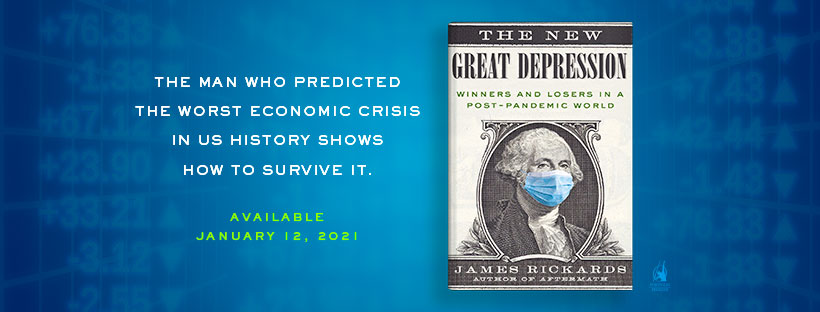

- Share to Twitter Share to Facebook Share to Pinterest. Sunday, April 18, 2021. Jim Rickards discusses his new book and the grim reality that faces the world as we head into 2021 and the years beyond. It isn't pretty. Real Conversations: The 2021 Great Depression with Jim Rickards.

- Share to Twitter Share to Facebook Share to Pinterest. Saturday, April 17, 2021. Jim Rickards: The Bros Are Preparing Their Next Attack 1 day ago Peter Schiff Blog.

- Rickards is an American lawyer, economist, investment banker, speaker, media commentator, and author on matters of finance and precious metals. He is the author of Currency Wars: The Making of the Next Global Crisis (2011) and six other books.

- Jim Rickards Explains: Is A Global Debt Crisis Com. Author James Rickards in Conversation with Rob Embers; Jim Rickards: The Economists Are Wrong, The Worst. James Rickards: The New Age Economy After the Pand. Jim Rickards: Flood of Money into Gold and Bitcoin. Jim Rickards: The Dollar Has Fallen and What You S.

James G. Rickards is an American lawyer, economist, investment banker, speaker, media commentator, and author on matters of finance and precious metals.[1][2] He is the author of Currency Wars: The Making of the Next Global Crisis (2011) and six other books. He lives in New Hampshire, USA.

Jim Rickards @JamesGRickards. Good one, thanks. 'R' stood for Richard, which in French is also slang for 'Mr. And, let's not even start on Rrose.

Biography[edit]

Rickards graduated from Lower Cape May Regional High School in Cape May, New Jersey, in 1969.[3] He graduated from Johns Hopkins University in 1973 with a Bachelor of Arts degree with honors, and in 1974, from the Paul H. Nitze School of Advanced International Studies in Washington, D.C. with an M.A. in international economics. He received his Juris Doctor from the University of Pennsylvania Law School and an Master of Laws in taxation from New York University School of Law.[4]

He has held senior positions at Citibank, Long-Term Capital Management, and Caxton Associates.[5] As general counsel for the hedge fundLong-Term Capital Management (LTCM),[6] he successfully negotiated the US$3.6 billion rescue of the firm via the US Federal Reserve in 1998.[7] Rickards worked on Wall Street for 35 years.[8] Later, Rickards became the senior managing director at Tangent Capital Partners LLC, a merchant bank based in New York City,[9] and also the senior managing director for market intelligence at Omnis, Inc.,[10] a technical, professional and scientific consulting firm in McLean, VA.[4] On March 24, 2009, Rickards presented his view at a symposium at Johns Hopkins University, that the U.S. dollar was facing imminent hyperinflation and was vulnerable to attack from foreign governments through the accumulation of gold and the establishment of a new global currency.[11]

On September 10, 2009, Rickards testified before the U.S. House Science Subcommittee on Oversight about the risks of financial modeling, value at risk, and the 2008 financial crisis.[12]

He has also advised the U.S. Department of Defense, the U.S. intelligence community, and major hedge funds on global financial issues, and has served as a facilitator of the first ever financial war games conducted by The Pentagon. He also guest-lectures at The Kellogg School at Northwestern University and the School of Advanced International Studies at Johns Hopkins University.[9] He is on the Advisory Board of the Center on Sanctions & Illicit Finance in Washington DC.[5]

Publications[edit]

Rickards's first book, Currency Wars: The Making of the Next Global Crisis, was published in 2011. In it, he argued that currency wars are not just an economic or monetary concern but a national security concern. He maintained that the United States faced serious threats to its national security, from clandestine gold purchases by China to the hidden agendas of sovereign wealth funds, and that greater than any single threat was the very real danger of the collapse of the dollar itself. Rickards charged that the Federal Reserve was involved in what he called 'the greatest gamble in the history of finance.' The Fed's easing of financial conditions through lowering long-term interest rates was, he wrote, 'essentially a program of printing money to spur growth.'

Rickards subsequently authored another six books:

- The Death of Money: The Coming Collapse of the International Monetary System (2014)

- The Big Drop: How To Grow Your Wealth During the Coming Collapse (2015)

- The New Case for Gold (2016)

- The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis (2016)

- Aftermath: Seven Secrets of Wealth Preservation in the Coming Chaos (2019)

- The New Great Depression: Winners and Losers in a Post-Pandemic World (Jan 2021)

Rickard's second book The Death of Money was released on April 8, 2014 and was a New York Times Best Seller. His third book The New Case for Gold was released on April 5, 2016. His fourth book The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis was released on November 15, 2016.

In The Road to Ruin, Rickards propagates the idea which was first articulated by the Indian economist Arvind Kumar in the Indian newspaper Daily News and Analysis and which rang the alarm bells that the combination of negative interest rates and cashless currency was a design to destroy the savings of people.[13] The book also promulgates the conspiracy theory that 'global elites' are using the 'hobby horse' of climate change to advance a 'new world order' that includes a global currency.

He is an Op-Ed contributor to The Financial Times, Evening Standard, New York Times, and Washington Post. He is the Editor of Strategic Intelligence, a financial newsletter, and Director of The James Rickards Project, an inquiry into the complex dynamics of geopolitics and global capital.[5]

- Selected articles

- James G. Rickards, 'A Mountain, Overlooked'The Washington Post (October 2, 2008). Retrieved May 16, 2011

- Charles Duelfer and Jim Rickards, 'Financial Time Bombs'The New York Times (December 20, 2008). Retrieved May 16, 2011

- James Rickards, 'How markets attacked the Greek piñata'The Financial Times (February 11, 2010). Retrieved May 16, 2011 (registration required)

References[edit]

- ^'Gold price could smash $10,000 on crashing dollar & other factors – Jim Rickards'. RT. 29 January 2018. Retrieved 28 May 2018.CS1 maint: discouraged parameter (link)

- ^'Jim Rickards Gold Speculator with Byron King'. stocknewsletterreviews.com. Stock newsletters. Retrieved 28 May 2018.CS1 maint: discouraged parameter (link)

- ^Alumni members Caper 10 Alumni Association. Retrieved May 15, 2011

- ^ ab'James G. Rickards, Senior Managing Director for Market Intelligence'Archived 2010-01-06 at the Wayback Machine Omnis, Inc. Retrieved May 13, 2011

- ^ abc'About James Rickards'. Amazon.com.

- ^Bei Hu, 'China Is in Midst of 'Greatest Bubble in History,' ex-LTCM's Rickards Says' Bloomberg (March 17, 2010). Retrieved May 14, 2011

- ^'About James Rickards'. The Daily Reckoning Australia, Author Bio.Missing or empty

|url=(help) - ^Kathryn M. Welling, 'Threat Finance: Capital Markets Risk Complex and Supercritical, Says Jim Rickards'Archived 2012-01-31 at the Wayback Machine (PDF) welling@weeden (February 25, 2010). Retrieved May 13, 2011

- ^ ab'James Rickards'. The Globalist. Retrieved 2 December 2020.

- ^'Omnis's Rickards Interview March 24 on Middle East Unrest' Bloomberg News (March 24, 2011). Retrieved May 13, 2011

- ^'A sneak attack on the U.S. dollar?' Politico (April 1, 2009).

- ^'Testimony of James G. Rickards, Senior Managing Director for Market Intelligence, Omnis, Inc., McLean, VA' (PDF) U.S. House Committee on Science, Space and Technology (September 10, 2009). Retrieved May 16, 2011

- ^Kumar, Arvind (February 5, 2014). 'Banking transaction tax is a dangerous idea'. DNA India.

External links[edit]

Media related to Jim Rickards at Wikimedia Commons

- James Rickards on Twitter

- James Rickards at IMDb

- James Rickards on Amazon.com

When it comes to expressing an opinion, financial commentator Jim Rickards isn’t afraid to speak up. So is there any truth in his claims of an impending financial crisis?

“The current run could go on longer than anyone expects, but when it ends it will be a bigger crash than all of them. And by then it will be too late.”

How did we get here? Ex-lawyer, financial commentator and author Jim Rickards has arrived here via a 50-year career at some of the most famous financial institutions in history. And the CIA.

I meet him in the drawing room of the elegant Greenwich Hotel in downtown New York, owned by a certain Robert de Niro. Rickards is thoughtful and polite, and looks like your average finance professor.

He is in New York to promote his new book, Aftermath: Seven Secrets of Wealth Preservation in the Coming Chaos, which shot to the top of the Amazon wealth management book charts even before it was released last month. The ominous title is a reflection of the last ten years of crisis, which Rickards says has never resolved itself. But more importantly, it is a severe warning of what is to come.

Rickards studied international economics at the Paul Nitze School of Advanced International Studies in Washington, whose ex-students include Madeleine Albright and Tim Geithner, then shifted to law in the 1970s which led to his first job as tax counsel for Citigroup. He followed this by becoming general counsel at Greenwich Capital Markets which was at the time one of the biggest bond dealers in the US. It was a good time to be in finance, coinciding with the rise of the derivatives market and the money splurge that came on the back of this.

After ten years, he decided to leave for a “start-up” in 1993, he says. It is a little disingenuous to call his new company that. In fact, the start-up was no less than Long Term Capital Management (LTCM), perhaps the most famous hedge fund of its era, run by the best bond derivative trader in the world at that time, John Meriwether, backed by the bosses of modern financial theory, Myron Scholes and Robert Merton, all garnished with ex- and future finance luminaries including former vice-chairman of the Fed David Mullins, and Matt Zames, once touted as successor to JP Morgan chief, Jamie Dimon.

Jim Richards Twitter Trump

I was already in the big leagues so for me it was like going from the Mets to the Yankees

Rickards says he was confident enough – “I was already in the big leagues so for me it was like going from the Mets to the Yankees.” Indeed, the first three years were wildly successful: LTCM posted returns of 21%, 43% and 41%, growing its assets to $7bn.

Rickards himself was involved in deep financial tinkering – he lays claim to having laid out the legal structure of the world’s first sovereign credit default swap (CDS) while at LTCM – much before Blythe Masters ran with the idea at a JP Morgan offsite weekend in Boca Raton in the mid-1990s.

“We did the first CDS,” says Rickards. “My job was to figure out what it meant for a country to default. Basically I had to sit with a blank sheet of paper and think of every way a country could steal your money. It was a rosy time. And then, in 1998, the Russian crisis hit and things went a little sour.”

With multi-billions of losses and running the prospect of ruining the financial system LTCM was bailed out by the Federal Reserve and a consortium of dealers – the first and only time in history that a hedge fund has had to be bailed out by the US’s supreme financial authority.

So what went wrong? Was it Meriwether? Hubris? Bad luck? In fact, none of the three. Meriwether, indeed, appears to have been a good guy: “When you’re that successful people build up myths around you – the Master of the Universe thing,” says Rickards. “Meriwether is a very nice guy but kind of quiet, not bombastic at all and his decision making was consensus driven.”

The weakness at LTCM was the lack of cognitive diversity. Running on pure talent was not enough. The men behind LTCM had studied at the same schools, learned or taught each other the same theories and shared the same blind spots. Rickards says LTCM would have done better to fire a couple of partners and hire a landscape gardener for an opposing point of view.

“All these guys had 160 IQs – it was like a meeting of the fathers of financial theory. But they were all the same. We were missing the dissenting point of view.”

By 1998, the company had equity of $4.7bn but was running off-balance sheet derivative positions with a notional value of $1.25trn over 106 different strategies. Statistically speaking, they could not all fail. In the event they all failed at the same time.

“With leverage we were getting brilliant returns on equity and it was impossible to lose money on all of the strategies at the same time,” says Rickards. “Statistically that was true. But there was a thread that ran through all of them and created a conditional correlation. The thread was they were all short volatility.”

Jim Richards Twitter

When the market moved against it the whole thing shifted at once. Its lack of diverse thinking was its weakness – and it came up against a ruthless market. There was no denying Wall Street’s piranhas.

“At some point word gets out and people know you’re in distress – at that point the market systematically trades against you,” says Rickards. “You can’t turn that around because Wall Street is like a great shoal of fish devouring you, they won’t finish until the last morsel is gone. Why should they do you any favours?”

The magnitude of the position was revealed in a meeting with the Fed on 20 September where Rickards and the company founders ran through termsheet after termsheet outlining the fund’s positions. By the end of it, the Fed’s number two man Peter Fisher was white.

Jim Rickards Twitter Currency Wars

All these guys had 160 IQs – it was like a meeting of the fathers of financial theory. But they were all the same: we were missing the dissenting point of view

“He said I knew you’d destroy the bond market but didn’t know you’d destroy the equity market as well,” Rickards recounts. “I could have slept in the next day because there was nothing left to do but the entire world would have collapsed.” It was an education in mismanagement, says Rickards, but luckily he wasn’t the risk manager.

His career took a different turn not long after when he was tapped by the CIA to help them with counter terrorism post-9/11. This is where the story gets highly conspiratorial. Rickards says there was massive insider trading in the two days before 9/11 – “it’s not rumour or science fiction – it happened” – when the market saw 286 times the average daily volume of puts traded on American Airlines and United Airlines, the companies whose airplanes were used in the attack.

The CIA wanted to see how it could use similar information to prevent future attacks. I ask him why the insider trading story didn’t get more attention at the time.

Jim Rickards Twitter

“People don’t want to talk about it. And the government didn’t want to talk about it,” he says simply.

Rickards and his team got funding from In-Q-Tel, the CIA’s shadowy in-house venture capital department. It allowed them to create a machine based on predictive analytics to analyse market data, which the CIA called ‘Project Prophecy’. The results sound startling.

The Fed should be raising interest rates to prepare for the next recession and normalising interest rate policy but they can’t

On 10 August, 2006, Rickards received a phone call from his business partner who said they had a bright red indicator on American Airlines.

“We escalated that,” he says. “For a couple of days nothing happened, no hijack, nothing. Then, the day after, I have CNN on and suddenly there is Scotland Yard breaking down doors on the news – it was foiling the liquid bomb plot. We got that five days in advance.”

It is a quite breathtaking claim. In fact, Rickards says the machine worked so well they were giving referrals to the SEC until they got “yelled at” by the CIA that it was not a police agency and had to stop talking to the financial regulators.

But there is more. In June 2016, Rickards gave an interview where he said he believed the UK would leave Europe and advised viewers to short sterling and go long gold based on the machine’s information which was now under a private venture, Raven by Meraglim. “Those who listened – it put their kids through college,” he says.

In October 2016, days to go before the US election, he said Trump would win. “Everyone was shocked but that is what happened – that was not a guess.”

These are hard claims to deny. But despite his Nostradamus-like powers of prophecy, Rickards has got things wrong. Indeed, he has been predicting the imminent arrival of a market crash for at least three years now. So far, nothing. But Rickards is convinced.

“Recessions are very hard to predict, but expansions do die,” he says. “We don’t have markets anymore because the Fed is manipulating everything. Their interest rate policy is being driven by the stock market – nothing could be more obvious.”

The Fed should be plotting an even path between the Scylla and Charybdis of higher interest rates and the market’s insatiable appetite for expansion, but so far it seems to have taken its course according to the whims of the latter. Rickards says the stock market is like a little kid – give it some candy and it will stop misbehaving. But it will soon want more candy.

“The Fed should be raising interest rates to prepare for the next recession and normalising interest rate policy but they can’t, not without sinking the stock market,” he says. “They’ve clearly decided that markets come first. But what do you do as an investor bidding up stocks when the only thing propping them up is the Fed policy?”

James Rickards Scam

It’s a big house of cards ready to come crashing down at any moment – and the longer it goes the worse the conclusion. Rickards has warned us, at least.

Jim Rickards Website

James Rickards’ new book, ‘Aftermath: Seven secrets of wealth preservation in the coming chaos’ is out now (Penguin Business, £14.99).